Check out the Advantages of VA Home Loans with a Local Mortgage Broker Glendale CA

Check out the Advantages of VA Home Loans with a Local Mortgage Broker Glendale CA

Blog Article

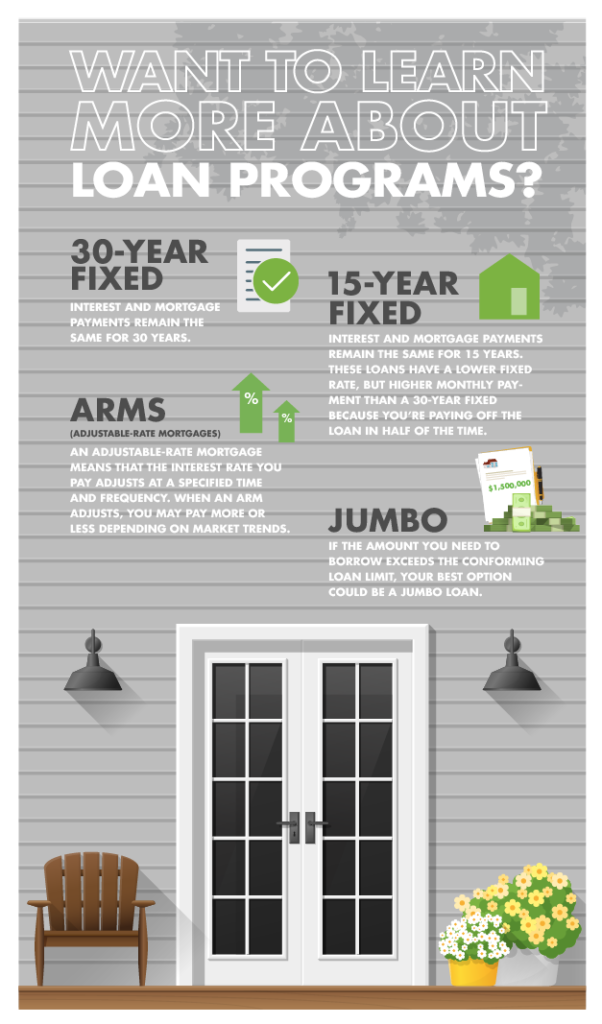

Understand Exactly How a Home Loan Broker Can Browse the Complexities of a Jumbo Loan for You

Understanding the complexities of acquiring a big funding can be daunting, yet an experienced mortgage broker can be your guiding light through this complex procedure. What makes a home mortgage broker absolutely essential in browsing big financings?

Specifying Jumbo Fundings

Jumbo lendings, also called non-conforming financings, are a kind of home mortgage developed for high-value buildings that go beyond the restrictions set by the Federal Real Estate Money Company (FHFA) for traditional adapting finances. These limits are adjusted yearly and vary by place, mirroring the varying residential property values across various areas. For 2023, the baseline conforming loan limit for a one-unit property is $726,200, with greater limitations in particular high-cost areas. Residence surpassing these limits call for a jumbo lending.

Jumbo financings provide to customers looking for funding for luxury homes or properties in affordable real estate markets. Typically, loan providers call for a higher credit score, substantial cash money books, and a bigger down repayment compared to adjusting financings.

The rates of interest for big loans can be higher due to the boosted risk, although they can often be affordable with conforming financing rates depending upon market conditions. Comprehending the nuances of big finances is essential for borrowers wanting to protect financing for high-value residential properties.

Role of a Home Loan Broker

An experienced home mortgage broker plays an essential duty in browsing the complexities of protecting a big lending. With the details entailed in these larger-than-conventional finances, their competence becomes invaluable. Mortgage brokers serve as intermediaries in between loan providers and consumers, leveraging their substantial network to recognize ideal loaning alternatives tailored to the consumer's economic situation. They diligently evaluate the debtor's creditworthiness, financial history, and particular lending demands to match them with the most effective feasible lending institution.

In the realm of jumbo lendings, where more stringent underwriting standards and greater deposit needs typically dominate, home mortgage brokers supply critical advice. They possess in-depth expertise of the loaning landscape, helping consumers comprehend pricing, terms, and problems, which can vary significantly among lenders - VA Home Loans. Their capacity to work out beneficial terms is crucial in securing competitive interest prices and loan conditions that straighten with the consumer's long-lasting economic goals

Additionally, mortgage brokers simplify interaction between all celebrations involved, ensuring openness throughout the funding process. Their duty prolongs to recommending customers on paperwork, giving understandings into market fads, and helping with a smoother transaction. Eventually, a skilled mortgage broker serves as a trusted advisor, simplifying the journey to acquiring a jumbo finance.

Streamlining the Application Process

Browsing the intricacies of a jumbo loan application can be discouraging without experienced help. A home loan broker plays a crucial duty in streamlining this complex procedure, making certain that debtors can efficiently take care of the needs of safeguarding a jumbo finance. These fundings typically go beyond the restrictions established by conventional financing, requiring an extensive understanding of one-of-a-kind needs and underwriting standards.

In addition, home mortgage brokers possess considerable understanding of the specific standards various lending institutions use to examine big funding applications. This proficiency allows them to match borrowers with lending institutions whose needs align with their economic profiles, improving the chance of authorization. Brokers also supply useful insights into the subtleties of the application process, clearing up each step and offering guidance on addressing any type of challenges or inquiries that may arise.

Bargaining Competitive Prices

Securing competitive prices on big financings calls for calculated negotiation abilities and a deep understanding of the loaning market. Home mortgage brokers play a crucial function in this process by leveraging their proficiency and connections with loan providers to make sure borrowers get the most desirable terms. Provided the substantial size of jumbo fundings, also small reductions in rate of interest can lead to considerable financial savings over the life of the car loan.

Home loan brokers use their in-depth understanding of market trends, rates of interest variations, and lending institution standards to provide a compelling case for affordable rates. They conduct extensive analyses of the debtor's financial profile, highlighting strengths such as high revenue, considerable assets, and excellent credit history, which can be prominent in protecting far better prices. Brokers typically have access to unique deals and price discounts not easily offered to private customers.

Brokers expertly browse financial signs and lending institution policies, encouraging clients on the optimal time to lock in prices. This critical approach eventually assists in more convenient and budget friendly big car loan plans.

Tailoring Lendings to Your Demands

When tailoring big lendings to fit specific demands, mortgage brokers must consider the distinct economic objectives and situations of each borrower. This involves a thorough analysis of the consumer's monetary account, consisting of income, credit report background, and long-term goals. By understanding these aspects, brokers can determine finance structures that align with the borrower's capability and ambitions, making certain that the home loan is both convenient and advantageous over time.

A vital part of customizing financings is selecting the proper rates of interest type-- dealt with or adjustable. Dealt with prices supply security, perfect go to this web-site for those preparing to stay lasting, while adjustable rates could fit consumers expecting adjustments in their economic circumstance or those that intend to offer prior to the price readjusts. In addition, brokers can change lending terms, balancing aspects such as regular monthly payments and total lending expenses view website to match the customer's preferences.

Moreover, brokers can provide advice on down repayment strategies, possibly minimizing finance quantities and staying clear of private home mortgage insurance policy. By checking out numerous lender programs, brokers can reveal niche products or incentives that might profit the borrower. Essentially, a home mortgage broker's know-how enables a custom funding service, customized precisely to fit the borrower's lifestyle and economic trajectory.

Final Thought

In conclusion, mortgage brokers play a crucial duty in facilitating jumbo financings by expertly navigating the intricacies involved. Brokers tailor loan terms to line up with customers' certain economic demands, ultimately enhancing end results.

Jumbo fundings, likewise known as non-conforming lendings, are a type of mortgage created for high-value properties that go beyond the limitations set by the Federal Real Estate Finance Agency (FHFA) for conventional adhering lendings. A home loan broker plays a critical role in streamlining this complex procedure, ensuring that consumers can efficiently take care of the needs of securing a jumbo car loan. Provided the considerable size of big loans, also minor decreases in passion rates can lead to substantial cost savings over the life of the lending.

When customizing jumbo finances to fit specific demands, home mortgage brokers should think about the unique economic goals and circumstances of each consumer. Furthermore, brokers can change finance terms, balancing aspects such as regular monthly repayments and general loan expenses to match the consumer's choices.

Report this page